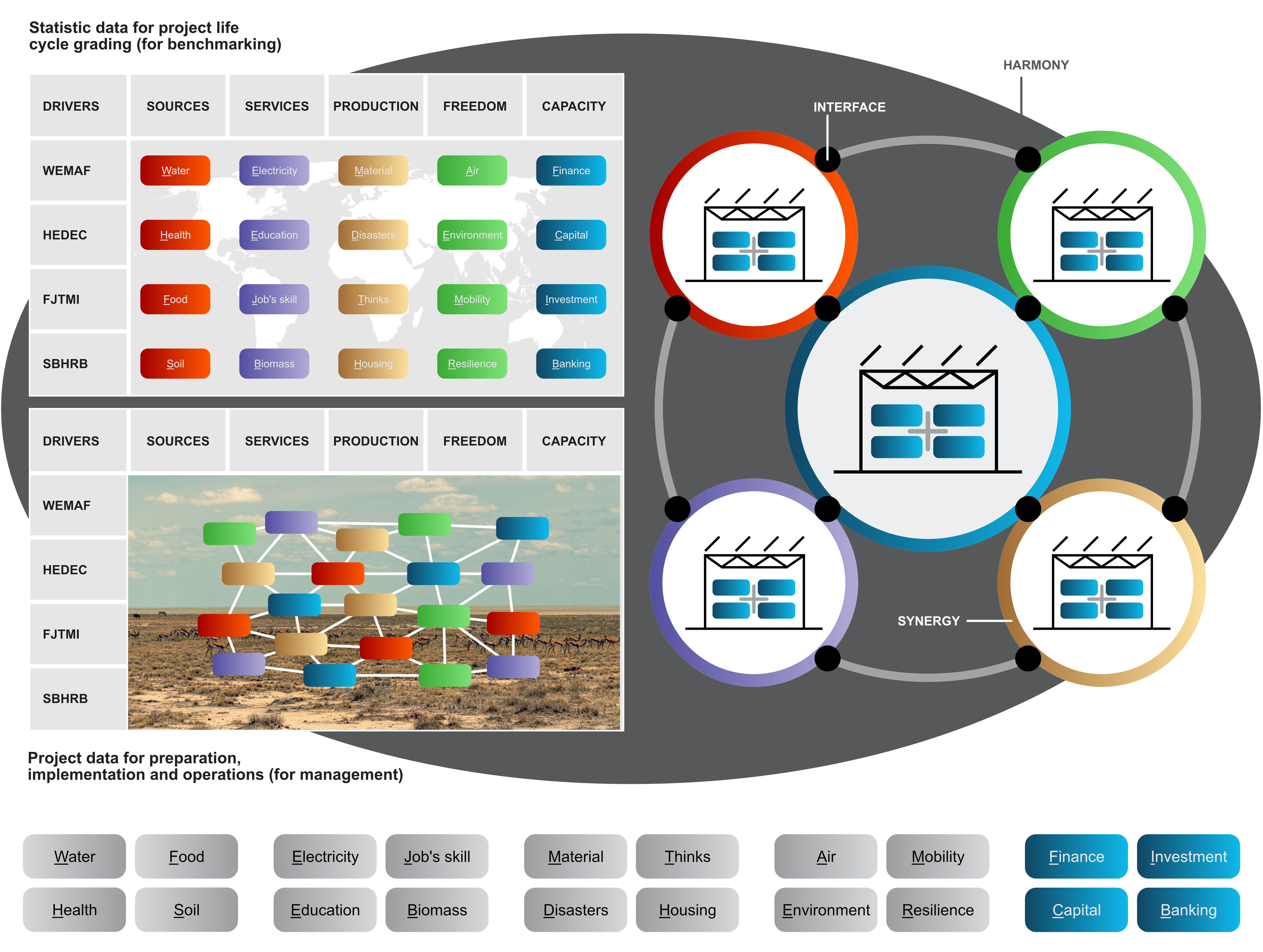

Figure F4e.0 Capacity (finance, capital, investment, banking)

Credit:

Pexels

Author's archive

Capacity can have many meanings (e.g., positive or negative). But in the physical sense, it is, e.g., a certain amount of water in a bottle that can reach a before-marked level, e.g., a mark on the bottle. For our model, we can use a virtual bottle with marked levels, which are changeable, reflecting the absorption capacity of each individual, team, or collective.

Absorption capacity here means their ability to reach financial, capital, investment, and banking services in the province where they are living and working. So, we transformed the physical model of the bottle into a changeable group (a virtual set) of persons, teams, and collectives. Then we can start to talk about the functions of money. To simulate different capacity levels regarding the power of cash generally and the absorption capacity on each address.

Four items (finance, capital, investment, banking) characterize the integration power of a human product, a "glue - money," especially crucial for the growing population today of about seven billion. The analogy to "glue" is symptomatic because we are talking about financial tools and operations that link all the human pleasure, development, and safety needs of the seven billion spontaneously and unevenly applied by the Human in the Great Triad (GT).

The principal need of the Human is to reach and sustain the Spin of human behavior in balance in the system of the GT (see Chapter C6, e.g., Figure C6c.1). That all under the laws of Nature (of life, based on biological principles) and in the Space (of its matter, other substances, and the time-space understanding). As a GT partner, the Human must respect that his/her laws are derived from Nature and Space law. People must know their positions in the state As-Is and generate knowledge growth of functions and risks during their To-Be stages in the GT environment.

The Capacity Sector is also talking about the ICT systems (e.g., FinTech), allowing them to improve his/her access to money (for social peace), capital building (for any worse times), investment (for any better times), and banking (for finance sustainability). The Webbook attempts to join the macro and micro-operation levels of financing the development and safety in low-income territories (provinces) worldwide.

Macro finance, in our case, is more about central governments and big corporate interests. It is an environment for large projects of direct foreign investment. Conversely, the micro-finance modes in situ belong to local administration and the medium and small enterprises primarily operating in the national (local) interests.

But generally, the spectrum of this Sector is much broader and compacter. It is also about currency competition and the international financial flow environment. It includes monetary policy, fiscal policy, investing, borrowing, lending, budgeting, saving, forecasting, and society (with personal, corporate, and public/government impacts).

It covers raising funds or capital, gaining critical investors, and building banking services. Many of these issues belong directly to International Financial Institutions (IFI), national governments and ministries, and other institutions in their responsibility. The role of the SPC Concept is to inform, cooperate and support the existing structures in four directions:

1. To assist them in the financial locations at the local position of the low-income territories,

2. To test the NPP in an objective spending process in provinces that need financing of the base elements of their local infrastructures,

3. To support a close investment synergy and cooperation between developed and other territories, namely those of the low-income provinces.

4. To find a solution and support the international phenomenon for fast enough growth of local capital also in the statistically poorest territories.

Capital is typically cash or liquid assets being held or obtained for financial expenditures on an external (for them mostly on local) market. The Capacity Section the context of table E1) is critical for any local development. Till now, and very often, it is accumulated around the capital city or the territory of direct foreign investment. But it is not enough.

The local government and entrepreneurs of any low-income province must also stride on the path of the distribution economy, take care of investment in a broad spectrum, and strengthen the local market via their effort. Their aim should be to maintain positive regional finance flows and stabilize and increase the provincial capital's social and economic prestige (with positive influences on the overall territory of the province and state).

But in any case, the physical (material) investments in the infrastructure of the whole province in solid links to the state (regional) infrastructural plans are crucial. This approach demonstrates the cultural and intellectual readiness of the local population to succeed in broader markets and enter the competitive environment of the worldwide business and social community.

Investment knowledge and skills feed purchases of goods and services and the readiness to participate in procurement services. Procurement is the most critical segment of investment via projects. Generally, investing is an effective way to let your money work and potentially build wealth. But in any case, intelligent and sustainable investing is based on the project's principles, not speculations.

Building and maintaining order in the financial world belongs to banks. I believe it is a sustainable mission also for the future. The proper stewards' ethical value protections and performances will need a trustful position in growing distribution in the business relationships in the global social environment.

Since time immemorial, banks have stabilized and developed the sustainability of finance, capital, and related investments. Therefore, banking is the most critical security item for spending and investment. Relying only on speculative wins and losses is a wrong (red) path (see dialectic diagrams of this Webbook).

Figure F4e complements the views on the Capacity Sector. It indicates the intersection of drivers (all twenty components) with the possibility of distinguishing statistical data values and data consumption for the preparation and implementation of projects (similarly like in all Figures F4a, F4b, F4c, F4d, and F4e).

Figure F4e indicates the role of the Capacity Sector in the Self-Powered Community environment via four components (finance, capital, investment, and banking). Other and more telling Figures, Photos, Videos, or Films can be displayed in later stages of this Website and added to the Open Webbook later.

In any case, the focus of work related to marketing and teaching new approaches, e.g., with the application, New Project Paradigm (NPP) inputs into the current practice of project management, will relate to the positions of TG and local FB. This applies to all five Sectors.

Figure F4e presents an ad-hoc choice of individual investment actions in low-incomes provinces of different states and continents. Introduces the first version of a group of such documentary blocks.

Figures F4.e